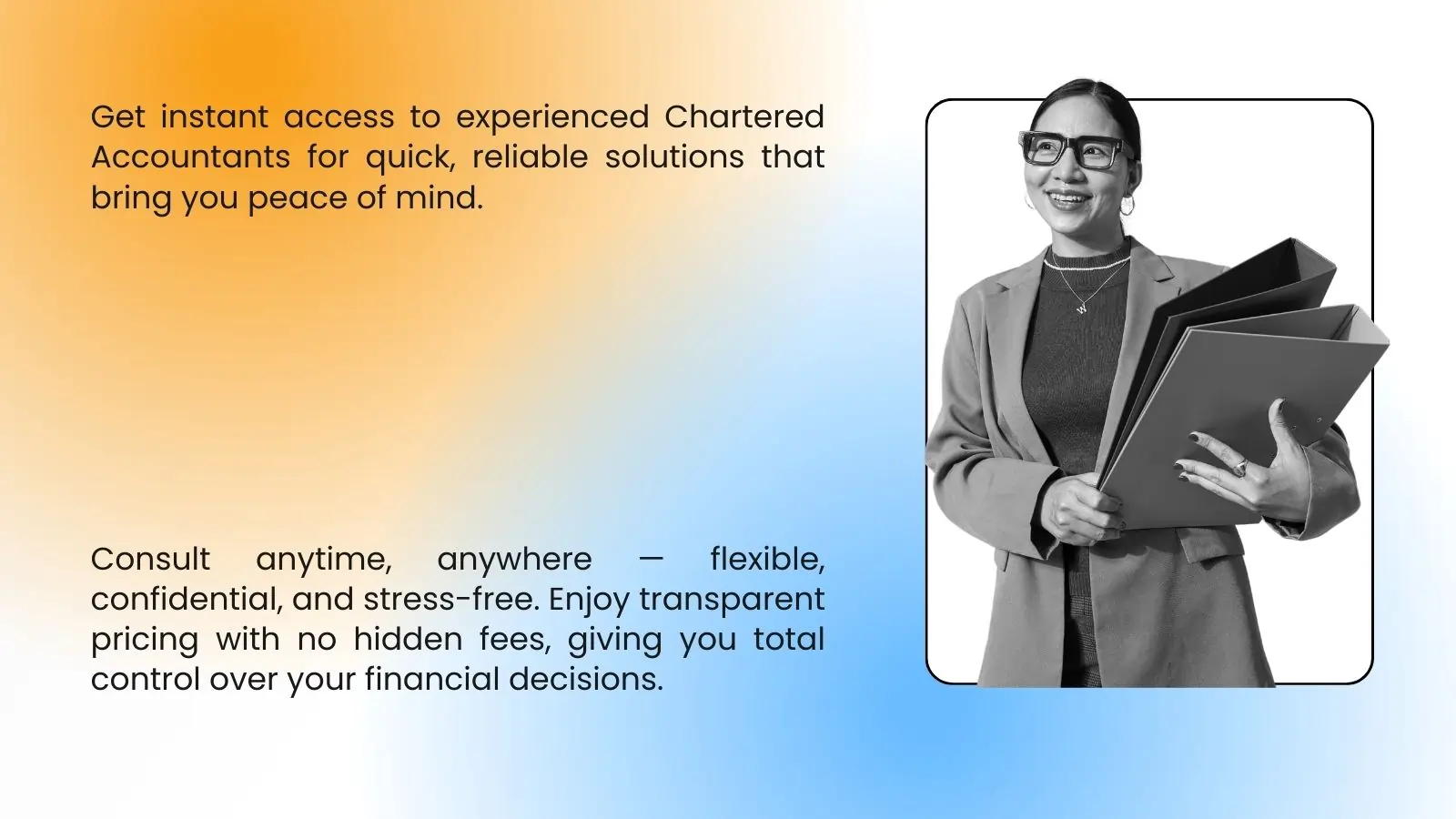

TALK TO A CHARTERED ACCOUNTANT

- Pay-per-use consultation at ₹999 for a 30-minute session.

- Ideal for straightforward tax/GST/TDS/accounting queries.

- Get an appointment in about one hour.

.webp)

Tap any node for CA insight + how we support.

Whether fully ready or still collecting pieces, we plug the gaps.

Filings and penalties depend on period. Keep AY/FY and months/quarters ready. We’ll validate and align the forms.

State the outcome (refund/rectification/filing/registration/notice reply) and the deadline. We’ll map steps and owners.

<embed src="nlp-ca-terms.pdf" width="100%" height="520" type="application/pdf">

Route to your checkout/WhatsApp/calendar: topic → slot → pay → dashboard.

Add form/phone/WA link. We help you choose topic and prep pre-brief.

Use this for simple, focused questions.

A clear query = a clear, quick answer.

For GST, TDS, ITR, payroll, ROC and routine compliance.

This lets the CA design a simple, ongoing compliance plan for you.

For serious matters or long-term planning.

Arriving prepared means your CA can move straight to solutions and structure.

Your vision, our expertise. Connect with us to explore possibilities. We will be happy to hear from you.